- Welcome Guest

- Sign In

- Welcome Guest

- Sign In

Contrary to what some folks think about the “recent” discovery of artificial intelligence for business uses, AI as a computing function is not novel. What is new is its growin...

Tech industry analyst Mark Vena explores how Qualcomm, AMD, and Intel are pivotal in driving AI-enabled advancements in PCs, potentially triggering a supercycle in sales amidst fluctuating market conditions an...

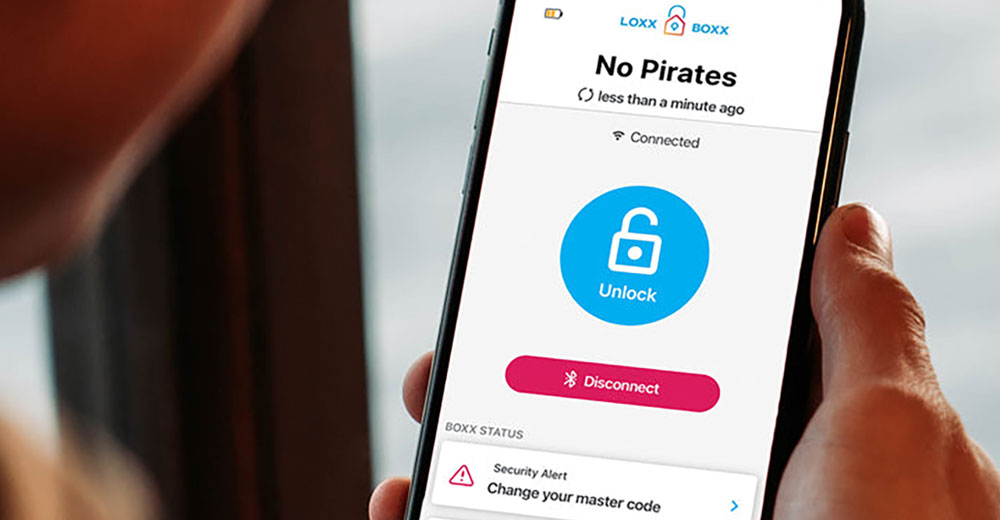

Brute force cracking of passwords takes longer now than in the past, but the good news is not a cause for celebration, according to the latest annual audit of passwor...

ConvertKit founder and CEO Nathan Barry bootstrapped his startup strategy 11 years ago with only $5,000 and a small garage to grow his fledgling firm into a $30 million business...

Nearly two dozen dating apps were flagged by Mozilla's Privacy Not Included researchers as failing to meet privacy and security standards, sharing customer data with third parties, and excluding th...