- Welcome Guest

- Sign In

- Welcome Guest

- Sign In

Mark Vena reviews the Beatbot AquaSense Pro, detailing its advanced features and performance in automated pool cleaning...

Following a prediction that Apple’s AI features in iOS 18 will be processed directly on iPhones, analysts discuss the implications for user privacy, device performance, and longevity...

As technologies like ChatGPT exemplify, generative AI is rapidly evolving, prompting businesses across industries to refine their application strategies. The challenge in 2024 is to leverage these new technologies t...

Bigeye's new Dependency-Driven Monitoring platform is a data observability solution that allows enterprise data teams to see more trustworthy results from their CRM systems...

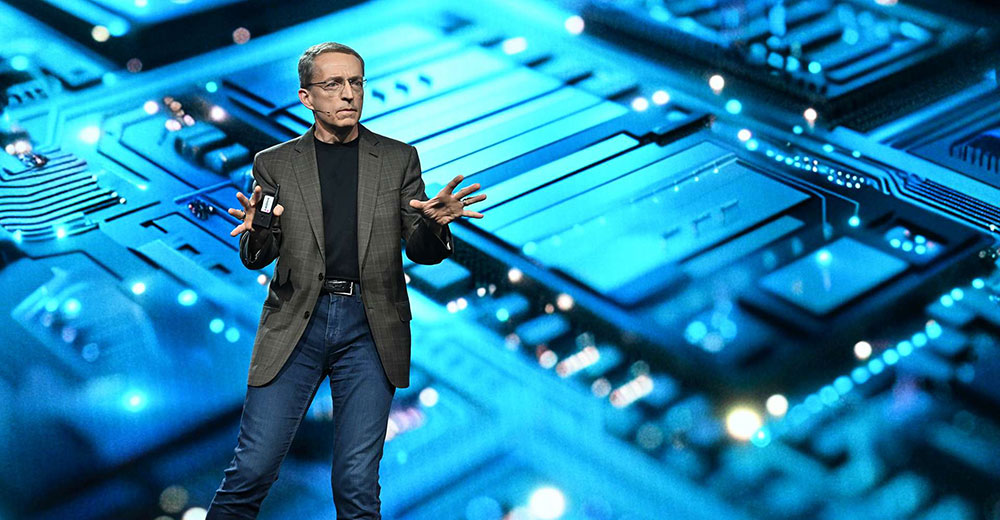

Tech analyst Rob Enderle discusses Intel's response to strategic challenges and how Michael Dell's renewed leadership at Dell signals a strong comeback amid critical AI threats...